Tesla’s Profits Crash 71% Amid Weak Sales and Rising Anti-Musk Sentiment

Tesla is facing one of its toughest quarters in recent memory, reporting a dramatic 71% drop in profits due to disappointing EV sales and growing political backlash tied to CEO Elon Musk.

In its Q1 2025 earnings report, Tesla disclosed $409 million in net income on $19.3 billion in revenue, after delivering nearly 337,000 vehicles. That’s a steep decline compared to the same quarter last year — and marks the company’s worst delivery quarter in over two years.

The company’s earnings were significantly propped up by the sale of $595 million in zero-emissions tax credits. Without these credits, Tesla would have posted a loss.

Yet despite the gloomy figures, Tesla shares rose in after-hours trading. Investors appeared optimistic about the company’s announcement that it would begin producing an affordable EV in June, and Musk’s claim during the earnings call that he would scale back his role at the Department of Government Efficiency to refocus on Tesla — though he added he may still stay involved in some capacity through President Donald Trump’s second term.

Tesla warned shareholders that Trump-era tariffs and “changing political sentiment” could negatively affect demand for its products moving forward. It emphasized that these tariffs — especially those targeting China — would “have a relatively larger impact on our Energy business compared to automotive.”

Tesla maintained that its plans to launch a more affordable EV are still on track for the first half of 2025, with Musk confirming production would begin in June. These models will leverage elements from the next-gen platform behind Tesla’s upcoming robotaxi, but will also utilize the existing platform used in the Model 3 and Model Y, and be built on current production lines.

This directly contradicts a recent Reuters report suggesting the launch would be delayed by several months.

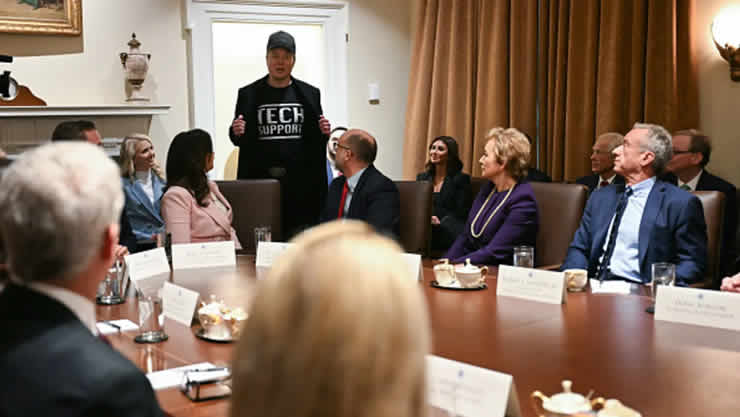

Tesla’s troubles are mounting. Its EV lineup, while updated with facelifts, is aging. The Cybertruck has failed to meet expectations. Musk’s political views — particularly his alignment with the far-right and the Trump administration — have also triggered significant brand backlash.

Meanwhile, Musk is doubling down on Tesla’s Robotaxi and Optimus robot efforts. He has promised to launch an initial Robotaxi service in Austin this June, with other cities potentially following by year’s end. However, he has been vague on execution details.

Despite years of promises, Musk has yet to show Teslas can operate fully autonomously without human intervention. According to The Information, Tesla’s internal analysis suggests the Robotaxi program is expected to lose money for a long time, even if it becomes operational.

This time last year, Tesla was already under pressure, reporting a 55% drop in Q1 2024 profits to $1.13 billion. In Q2 2024, it posted a 45% drop in profit, partially due to a $622 million restructuring charge. That quarter’s outcome was also padded by a record $890 million in regulatory credit sales.

With an uncertain global outlook, trade tensions, and political backlash mounting, Tesla is racing to stabilize its future.