Elon Musk’s First White House Month Coincides With Tesla’s Worst Performance Since 2022

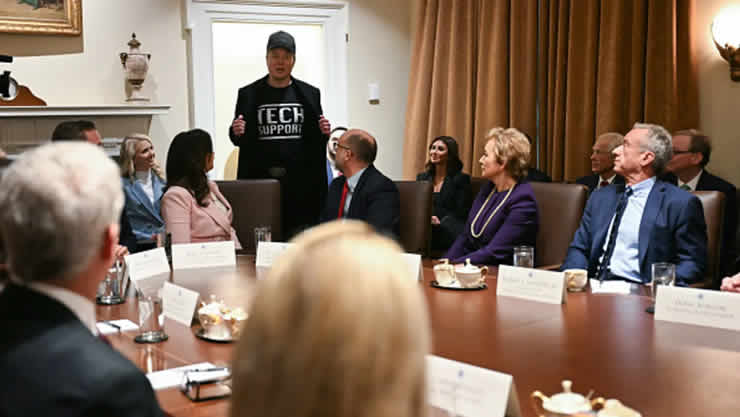

Newly appointed White House Chief Strategist Elon Musk has sparked controversy as Tesla shares plummeted 28% during his first month in government service—the electric vehicle maker’s steepest monthly decline since 2022. Industry analysts suggest Musk’s dual role has created investor uncertainty about his focus on Tesla’s core operations.

Market analysts at Wedbush Securities noted Tesla’s stock drop coincides with Musk’s reduced public communication about EV innovation. “Investors expected Musk to clarify his White House priorities versus Tesla leadership during the Q4 earnings call, but he deferred questions to CFO Zach Kirkhorn,” said analyst Dan Ives.

The Biden administration defends Musk’s appointment, emphasizing his “unique perspective on sustainable technology.” However, critics argue Tesla’s delayed Cybertruck production and canceled Model 2 development reveal strategic drift. Musk countered these claims on X (formerly Twitter), stating: “Tesla’s long-term vision remains unchanged. Temporary stock fluctuations don’t reflect fundamentals.”

Energy sector experts highlight an unexpected consequence: Tesla’s decline contrasts with 18% growth across rival EV stocks. “This isn’t just about Musk’s divided attention,” said BloombergNEF’s Corey Cantor. “New federal EV subsidy rules favoring unionized automakers directly disadvantage Tesla.”

As Washington policymakers debate clean energy incentives, Tesla investors await Musk’s next move. Will the billionaire prioritize government policy shaping or return to hands-on Tesla leadership? The answer could determine whether this stock slump becomes a long-term trend.