It’s gone from bad to worse for tech investors.

With the Nasdaq suffering its steepest drop since 2022 on Monday, the seven most valuable tech companies lost more than $750 billion in market value. Recession fears and concerns about a trade war drove the selloff.

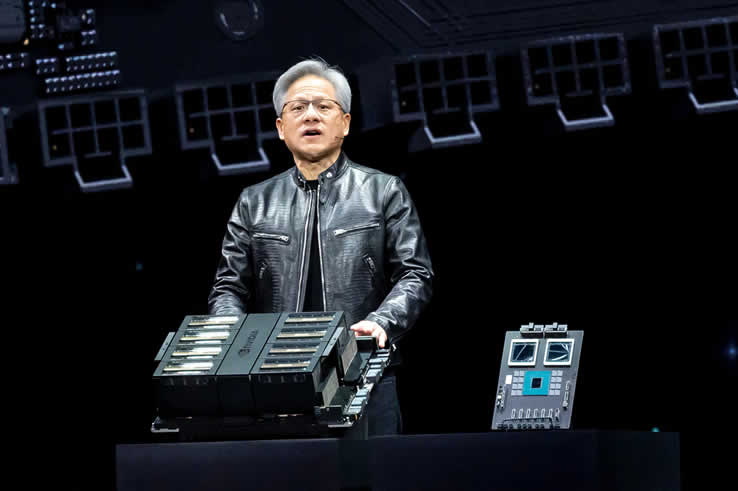

Apple led the megacap losses, with its value plummeting by about $174 billion. Nvidia shaved off almost $140 billion in market value and shares closed down 5%. The leading AI chipmaker has lost nearly a third of its value just two months after notching a fresh high in January.

Tesla had the biggest percentage loss, with shares of the electric vehicle maker tumbling 15%, their worst day since 2020. The company has lost more than half its value since its stock price peaked in mid-December. The stock is also coming off its longest weekly losing streak in history as a public company.

Tesla lost $130 billion in value on Monday, while Microsoft and Alphabet lost $98 billion and $95 billion, respectively. Amazon lost $50 billion and Meta lost $70 billion.

Alphabet and Meta dropped more than 4% on Monday, while Microsoft and Amazon dropped at least 2% each. The Technology Select Sector SPDR Fund fell more than 4%, entering correction territory. Shares are more than 14% off their high.

NVIDIA Corporation (NASDAQ: NVDA) shares have plummeted 30% from their 2025 peak as a brutal tech-led sell-off rattles Wall Street’s once-unshakable “Magnificent Seven” stocks. The chipmaker’s dramatic decline mirrors broader market anxieties about overvaluation in the AI sector and rising interest rates.

The selloff accelerated after Federal Reserve Chair Jerome Powell hinted at prolonged monetary tightening during Tuesday’s policy meeting. NVIDIA, which had soared 250% since 2023 on artificial intelligence hype, now faces its steepest correction since the 2022 crypto crash. Analysts attribute the drop to profit-taking by institutional investors and growing concerns about slowing data center demand.

“This isn’t just a NVIDIA story—it’s a reckoning for the entire tech sector,” warned Morgan Stanley’s chief equity strategist. “The Magnificent Seven stocks collectively lost $2 trillion in market cap this month alone, erasing all 2025 gains.” The group, which includes Apple, Amazon, and Meta, now trades at an average P/E ratio 22% below January levels.

While some traders see buying opportunities, regulatory filings reveal hedge funds are shorting NVIDIA at the highest rate since 2020. The company’s upcoming earnings report, particularly its guidance on AI chip shipments, could determine whether the $1.7 trillion firm regains momentum or extends its slide.