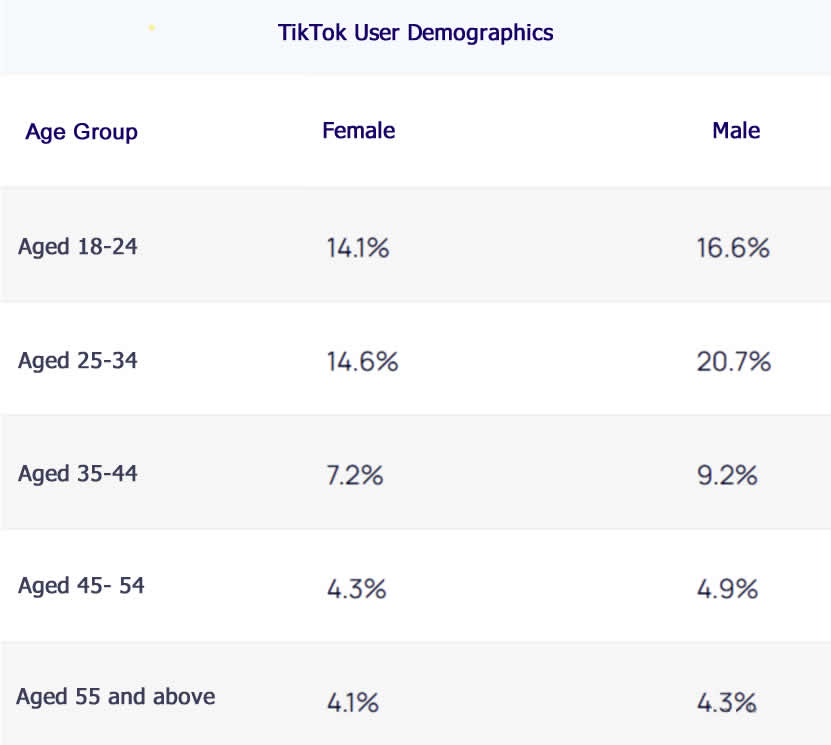

When TikTok gradually entered the public eye in domestic markets, nearly all e-commerce sellers focused their attention on the 25–34-year-old demographic. It made sense — this group has strong purchasing power, is willing to spend on personal interests, and is more prone to impulsive buying.

But today’s story isn’t about the young generation. Instead, it’s about the sharp sellers who shifted their focus to middle-aged and elderly consumers — and suddenly started seeing explosive sales growth.

As of August 2025, data shows that the number of TikTok Shop sellers surpassed Shopee for the first time, reaching 266,000 sellers, a 96% year-over-year increase.

In the past, people often said that Shopee, as a veteran e-commerce platform, was fiercely competitive. Now, it’s fair to say TikTok has become the new battlefield.

Beyond seller competition, several factors are holding new entrants back:

1. Concentration of top sellers:

The number of large sellers with GMV exceeding 50 billion VND grew by 95%, while 38,000 small and mid-sized sellers exited the platform. This indicates a clear shift of platform resources toward top-tier merchants, and buyers are forming a habit of purchasing from established, popular livestream rooms.

2. Changing consumer behavior:

79% of users place orders based on content recommendations, with short videos and livestreams driving 1.9x and 2.3x sales growth, respectively.

This shows that around 20% of users still prefer to search for products directly in the TikTok Shop marketplace. While product card listings and video-based sales still have potential, livestreaming remains the strongest driver of conversions and growth.

3. Payment and logistics breakthroughs:

TikTok Shop has partnered with ZaloPay as its first e-wallet payment partner, and teamed up with J&T Express to launch a “48-hour delivery” service.

This raised payment success rates from 65% to 92%, while cutting delivery time to one-third of traditional models.

The faster the logistics, the greater the advantage for sellers with local operations and solid capital flow. In contrast, small and cross-border sellers are gradually losing market share.

Turning to the Lower-Tier Market

Unable to compete in saturated segments, many sellers are now turning to the untapped “lower-tier market” — areas with little competition, minimal returns, and ultra-low operational costs.

These sellers are shifting their strategies:

- From high-end products to budget-friendly ones

- From young consumers to silver-haired seniors

- From urban needs to rural demands

The key lies in subsidies.

Already low-priced goods become almost free after platform discounts — in many cases, consumers can buy items for just 2–3 RMB.

When products go viral, it’s easy to achieve hundreds or even thousands of daily orders.

Although profit margins are thin, return rates are near zero. Older consumers are often less familiar with return procedures, and since the product value is so low, they rarely find it worth the effort to return items.