According to the latest statistics released by third-party data platform Echotik, TikTok Shop achieved approximately $19 billion in gross merchandise volume (GMV) in the third quarter of this year — equivalent to RMB 135.7 billion — maintaining rapid overall growth.

TikTok Shop Q3 GMV: $19 Billion

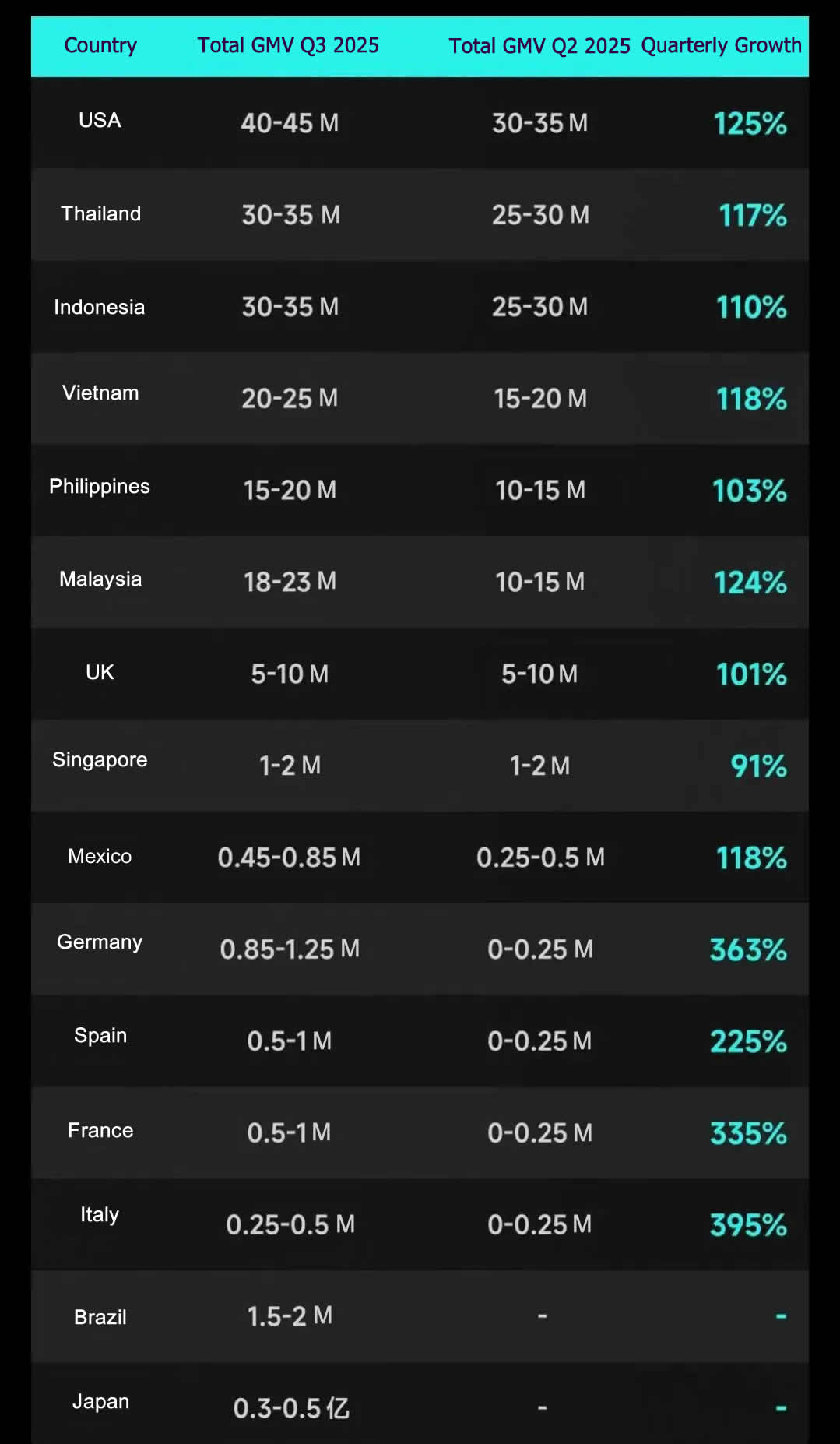

By region, the United States remains the top contributor to total revenue, ranking first in GMV with an estimated $4–4.5 billion, roughly double compared to the previous quarter. Following closely are several popular Southeast Asian markets — Thailand, Indonesia, Vietnam, the Philippines, and Malaysia — each generating several billion dollars in GMV with quarter-over-quarter growth exceeding 100%.

In Europe, the United Kingdom continues to be the largest and earliest established market, reporting a Q3 GMV between $500 million and $1 billion. Smaller or newly launched sites such as Singapore, Mexico, and Germany ranked lower in total GMV due to their limited market size or shorter operating time.

However, these newer sites are also the fastest-growing, especially across four new European markets — Germany, Spain, France, and Italy — which saw 2x to 3x quarter-over-quarter growth. Among them, Italy ranked last by volume but led in growth, nearly 400% higher than Q2.

TikTok Shop Q3 GMV by Market

In terms of product categories, beauty and personal care continued to dominate as the top-performing segment, with GMV reaching $3.5–4 billion — a 105% increase from the previous quarter. Next came women’s apparel and lingerie, mobile & electronics, health supplements, and food & beverages. This indicates that TikTok Shop markets share similar consumption patterns, with the platform’s social media DNA remaining a key driver of its e-commerce growth.

This connection is most evident among the top-performing TikTok Shops. Regardless of their category, these stores stand out for their exceptional content creation and strong social engagement.

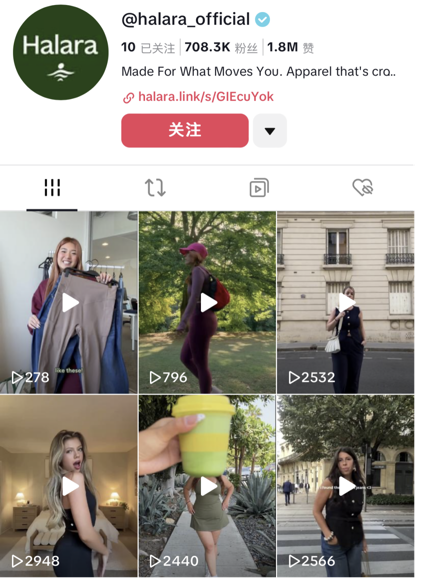

For example, in the U.S. market, women’s fashion brand Halara achieved an estimated $20–25 million GMV in Q3. Before officially launching its TikTok Shop, Halara had already invested heavily in social media marketing, generating billions of views. As of now, its official TikTok account has over 700,000 followers.

Halara Official TikTok Account

Another example is POP MART, whose social influence is well-known. The global popularity of its character LABUBU helped drive POP MART’s revenues sharply upward. In Q3, both POPMART US SHOP and POP MART US LOCAL ranked among TikTok Shop’s overall GMV leaders.

Overall, as content-driven e-commerce continues to grow, TikTok Shop has become not just a sales channel but also a strategic battlefield for global brands to capture consumer attention and loyalty. This influence is expected to extend outward, driving growth across multiple retail channels.

However, this also means that sellers on TikTok must go beyond traditional e-commerce thinking — focusing their limited resources on creative, flexible, and conversion-driven content to capture the dividends of the content commerce boom.

The Rise of Social Commerce

TikTok’s content e-commerce is, in essence, a form of social commerce. In today’s entertainment-driven internet era, social traffic is playing an increasingly pivotal role in shaping the e-commerce landscape.

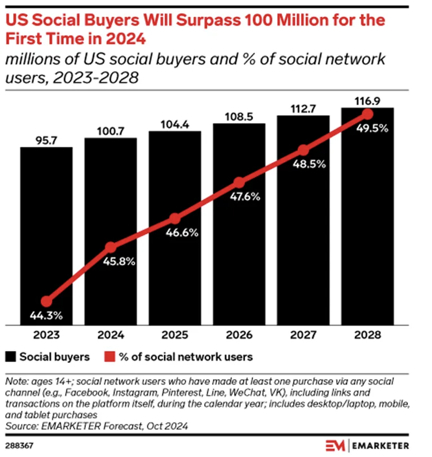

According to market research firm eMarketer, U.S. social commerce sales are expected to reach $71.6 billion in 2024, marking a 26% year-over-year increase. The number of social buyers in the U.S. will also surge past 100 million, with annual growth projected to remain around 40% in the coming years.

U.S. Social Commerce Buyer Growth

Among major social platforms — Facebook, Instagram, Pinterest, and TikTok — TikTok has the highest purchase frequency per user. It also leads in projected new buyer additions, with an expected 3.9 million new users joining the platform’s social commerce ecosystem.

This social commerce trend is also spreading worldwide. According to Statista, the global social commerce market is estimated to reach $688 billion in 2024, up 20% year-over-year, and is forecasted to exceed $1 trillion by 2028.

Against this backdrop, both social media and traditional e-commerce platforms are actively embracing social commerce models.

In late 2023, YouTube partnered with Southeast Asian e-commerce giant Shopee to launch a joint affiliate program called “YouTube Shopping.” Through it, Shopee integrates product links within YouTube videos, allowing viewers to click and purchase directly on Shopee, while creators earn commissions from sales.

YouTube Partners with Shopee on “YouTube Shopping”

This year, the partnership expanded to Thailand, Vietnam, Singapore, and the Philippines, covering most major Southeast Asian markets. Official data shows that, in the first half of the year, participating brands saw 1.7x higher views, 1.6x larger customer bases, and 3.3x higher sales. Over one-third of YouTube creators also reported increased income through the affiliate program.

Additionally, Shopee has built its own short-video feature, Shopee Video, to leverage social engagement within its platform. In Brazil, Shopee Video attracted 5 million users, 3 million sellers, and 1 billion views within just three months of launch.

Shopee’s Short Video Feature — Shopee Video

In short, the boundaries between social media and e-commerce are blurring. Both sides aim to leverage each other’s strengths to capture new traffic opportunities. For sellers, this marks a crucial shift: using high-quality content and storytelling to boost performance and ride the wave of social commerce transformation.