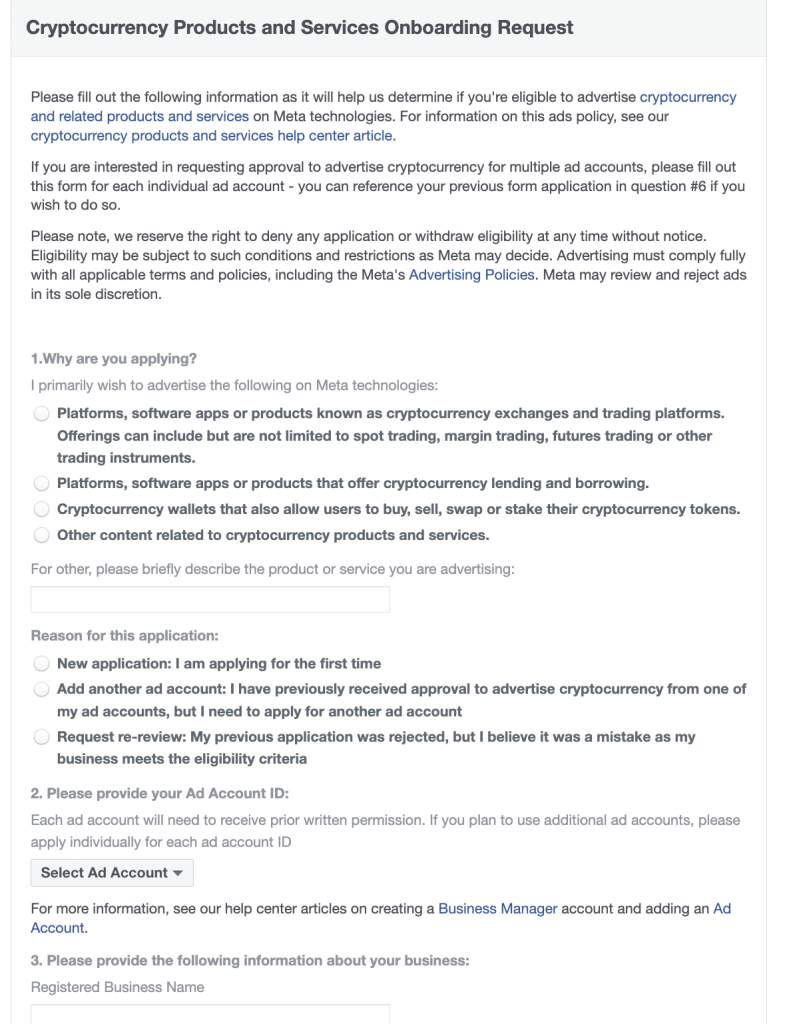

To reduce risk for consumers, Meta requires advertisers seeking to promote cryptocurrency trading platforms, software or services, and products that use blockchain technology to provide evidence that their activities are properly licensed. To run ads with Meta, advertisers need to submit a recognized regulatory license or registration and complete a whitelisting form request.

Q: What are the fintech apps that need to be whitelisted?

A: Types of ads that require written permission to promote:

① Cryptocurrency exchange or trading platform: a platform, software application, or product that enables people to exchange cryptocurrencies and money. This includes, but is not limited to, spot trading, leveraged trading, futures trading, and other trading tools involving cryptocurrency assets

② Cryptocurrency lending: a platform, software application, or product that allows people to borrow or lend cryptocurrency

③ Cryptocurrency wallets that provide additional services: devices or software that allow people to safely store cryptocurrency and provide additional services, such as:

·Buy or sell

·Exchange one cryptocurrency for another

·Stake or buy and hold tokens to earn interest

·Cryptocurrency Mining: Hardware or software that supports the mining of cryptocurrency assets

A:

① Provide tax services for cryptocurrency companies

② Events, education, or news related to cryptocurrency or blockchain technology, as long as they do not provide cryptocurrency products or services

③ Non-virtual currency services and products based on blockchain technology, such as non-fungible tokens (NFT)

④ Cryptocurrency wallets that allow people to store cryptocurrency but do not provide additional services, such as buying, selling, exchanging, or staking cryptocurrency assets

When requesting permission, proof of possession of one of the following licenses or registrations will also be required:

▲ Australia:

AUSTRAC Registered, Issued by: Australian Transaction Reports and Analysis Center (AUSTRAC)

Australian Financial Services License/Australian Market License, Issuer: Australian Securities and Investments Commission (ASIC)

▲Austria:

Registered as a virtual currency provider under the Austrian Financial Markets Anti-Money Laundering Act, Issuer: Financial Markets Authority (FMA)

▲Canada:

Registered as a Money Services Business, Issued by: the Financial Transactions and Reports Analysis Center of Canada (FINTRAC)

▲ Estonia:

Virtual currency service authorization, issuing agency: Financial Intelligence Unit

▲Finland:

Registration in the Register of Virtual Currency Providers, Issuer: Financial Supervisory Authority (Fin-FSA)

▲ France:

Digital Asset Service Provider Registration or License, Issuer: Autorité des Marchés Financiers (AMF)

▲Germany:

Authorized by BaFin, issued by: Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin)

▲ Gibraltar:

Distributed Ledger Technology (DLT) Provider Registration, Issuer: Gibraltar Financial Services Commission (GFSC)

▲Hong Kong:

Licensed or registered by the SFC for Type 1, 7, and 9 regulated activities, Issuer: Securities and Futures Commission (SFC)

▲ Indonesia:

Approved by the Indonesian Commodity Futures Trading Regulatory Authority (BAPPEBTI), Issuer: Commodity Futures Trading Regulatory Authority (BAPPEBTI)

▲Japan:

Crypto asset trading service provider registration, issuing agency: Japan Financial Services Agency (FSA)

▲ Luxembourg:

Virtual Asset Service Provider (VASP) registration, issuer: Commission de Surveillance du Secteur Financier (CSSF)

▲Malaysia:

Recognized Market Operator (RMO) status, Issuer: Securities Commission Malaysia (SC)

▲Malta:

MFSA License under the Virtual Financial Assets Act (CAP 590) Issued by: Malta Financial Services Authority (MFSA)

▲ Netherlands:

Registered with the Dutch Central Bank (DCB), Issuer: Dutch Central Bank (DCB)

▲Norway:

Registered with the Financial Supervisory Authority (Finanstilsynet), Issuer: Finanstilsynet

▲Philippines:

Certificate of Authorization (COA) to Operate as a Virtual Asset Service Provider (VASP) Issued by: Bangko Sentral ng Pilipinas (BSP)

▲Portugal:

Virtual Asset Service Provider (VASP) registration, issuing agency: Bank of Portuga

▲Singapore:

Obtained a digital payment token (DPT) service license from the Monetary Authority of Singapore (MAS) under the Payment Services Act. Issuer: Monetary Authority of Singapore (MAS)

▲ South Korea:

Virtual Asset Service Provider (VASP) report (can only be obtained after obtaining ISMS certification), issuing agency: Korean Financial Intelligence Unit (KoFIU)/Financial Services Commission (FSC)

▲Spain:

Registered as a provider of exchange services between virtual currencies and fiat currencies and a managed wallet provider, Issuer: Banco de Espana (Bank of Spain)

▲Sweden:

Registered with the Financial Supervisory Authority (FSA), Issuer: Financial Supervisory Authority (FSA)

▲Switzerland:

Fintech license registration, issuing authority: Swiss Financial Market Supervisory Authority (FINMA)

▲Thailand:

Digital asset business license, issuing agency: Thailand Securities and Exchange Commission (SEC)

▲ United Arab Emirates:

License to engage in arranging, consulting, trading, management, or other related financial services and/or operating an exchange and/or providing money services – all related to crypto-assets, Issued by: Abu Dhabi Global Market, Financial Services Regulatory Authority

License to operate stored value instruments (including virtual assets), issued by: within the United Arab Emirates, Central Bank of the United Arab Emirates

License to engage in investment business/operate an exchange – specific to investment tokens, Issuer: Dubai International Financial Center, Dubai Financial Services Authority

Full Market Product (FMP) License Registration for Operating Virtual Asset Trading Services, Issuer: Virtual Assets Regulatory Authority

▲ UK:

Authorized by the Financial Conduct Authority, Issued by: Financial Conduct Authority (FCA)

▲ USA:

FinCEN MSB Register, Issued by: Financial Crimes Enforcement Network (FinCEN)

BitLicense, Issued by: New York State Department of Financial Services (NYSDFS)

Cryptocurrency whitelist link

https://www.facebook.com/help/contact/532535307141067

*The review cycle is one week. Qualifications not within the scope of Meta, qualifications that do not match the subject (such as ec applying for teto whitelist), etc. will cause the qualification application to fail.

* At the same time, please note: Usually the advertiser should have a local entity in the advertising area (assuming it is A). It is recommended that he put this entity A under Meta’s account opening entity (assuming it is B), and then apply for a cryptocurrency whitelist through the link. The subject should be written as B.

For cryptocurrency advertising ads, you must clearly define your app type, ensure the app is compliant, and set aside time to apply for a whitelist. Finally, I would like to share a little tip. After submitting the whitelist application form, you can save the form URL. The feedback time will be about 3 working days. Save the link to avoid getting lost~